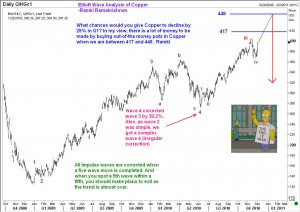

Copper is making a 3-week high as base metals are rallying. Firmer global equity market and supportive economic data are cited for this move. Some are speaking of a looming deficit in copper supplies, expected to push prices to record highs. Do we have anything different to say? Yes. Not because we wish to be different, but because a five wave move is nearing completion. Take a look at the attached chart of Copper (The conituation contract). Elliott wave analysis of copper suggests that once we reach above 415 levels, there is a growing danger for prices to top out. The outer target is currently placed at 448. What could trigger a reversal up there? Honestly I haven’t the faintest idea. But I would urge traders and hedgers to be aware of the phenomenon witnessed in millions of chart patterns that when a five wave move finishes, we will get a correction of the entire move, usually back to the area of the prior 4th wave of one lesser degree. In the case of copper, this means a potential move of 25% down once we top out. The key question is when will we know that copper has actually topped out? It is hard to say at this point, but if one were to watch the intraday data, pehhaps he will be able to spot a mini 5th of the 5th of the 5th! But for most people the best way to deal with this is to wait for a sharp downmove, and sell on a recovery with stops above the high seen. That often works! Good luck.

Copper is making a 3-week high as base metals are rallying. Firmer global equity market and supportive economic data are cited for this move. Some are speaking of a looming deficit in copper supplies, expected to push prices to record highs. Do we have anything different to say? Yes. Not because we wish to be different, but because a five wave move is nearing completion. Take a look at the attached chart of Copper (The conituation contract). Elliott wave analysis of copper suggests that once we reach above 415 levels, there is a growing danger for prices to top out. The outer target is currently placed at 448. What could trigger a reversal up there? Honestly I haven’t the faintest idea. But I would urge traders and hedgers to be aware of the phenomenon witnessed in millions of chart patterns that when a five wave move finishes, we will get a correction of the entire move, usually back to the area of the prior 4th wave of one lesser degree. In the case of copper, this means a potential move of 25% down once we top out. The key question is when will we know that copper has actually topped out? It is hard to say at this point, but if one were to watch the intraday data, pehhaps he will be able to spot a mini 5th of the 5th of the 5th! But for most people the best way to deal with this is to wait for a sharp downmove, and sell on a recovery with stops above the high seen. That often works! Good luck.

Copper Futures Outlook

Unleash your Potential

Transform your trading – Starting Today